How to Prepare for a Hail Storm: Tips for Homeowners

Hailstorms can strike quickly and leave costly damage in their wake–from dented roofs and siding to cracked windows and damaged vehicles. With hail season ramping up, it’s more important than ever to prepare your home, understand your insurance coverage, and protect what matters most.

When is hail season?

Across much of the United States, hail season typically runs from early spring through summer (March–August), with peaks often seen in May and June—though timing can vary regionally. In “Hail Alley” (parts of Colorado, Texas, Nebraska, and surrounding states), storms may begin as early as March and extend later into the year.

No matter where you live, a hailstorm can develop with little warning—so preparation ahead of time is key.

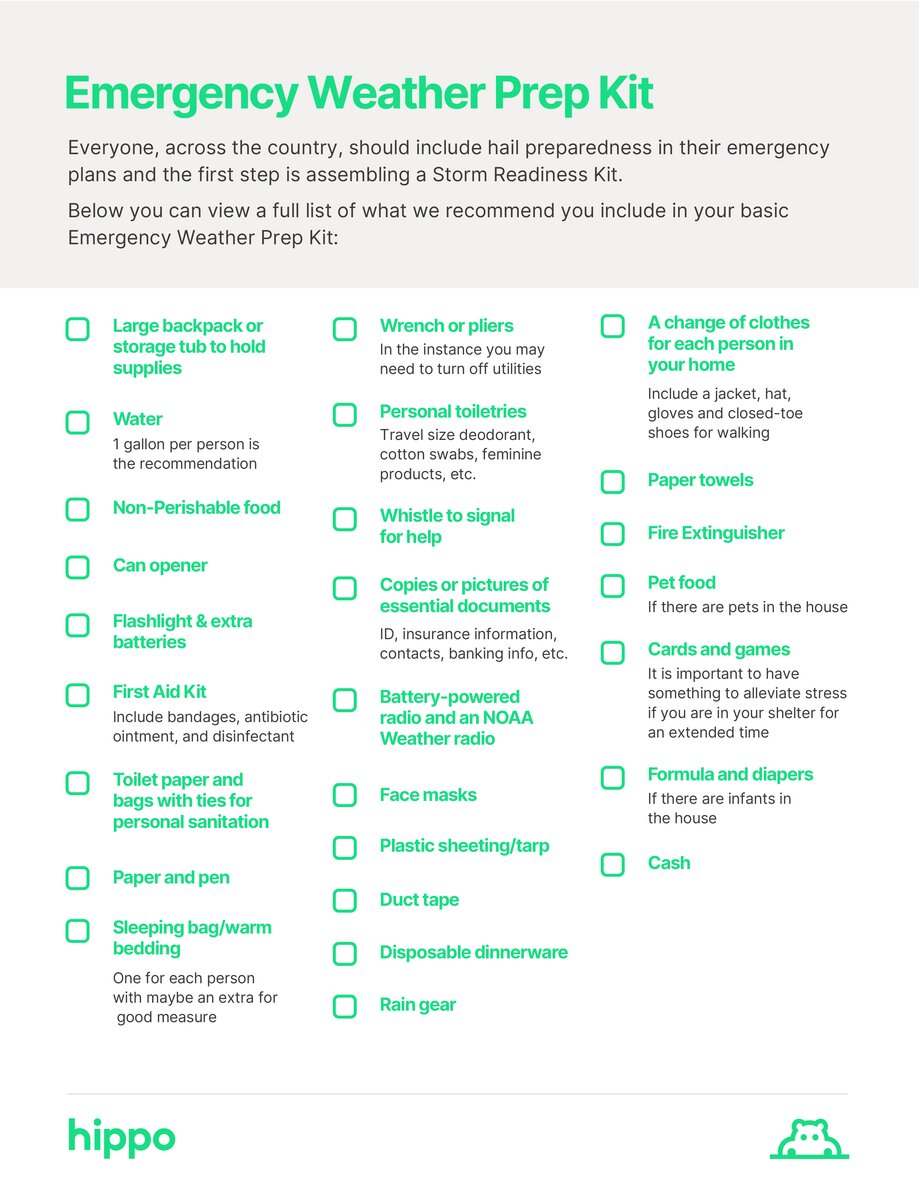

Make a kit

1. Gather your storm readiness kit

A basic weather emergency kit helps keep your household safe and self-sufficient if a severe storm hits. You may want to consider including the following items in your emergency kit:

- Flashlight and extra batteries

- First aid supplies

- Non-perishable food and water

- Important documents (insurance information, identification, banking information)

- Portable battery radio or NOAA weather radio

- Pet food and supplies

- Cash and basic tools

If you already have a general emergency kit, consider adding items specific to hail readiness, such as extra blankets, gloves, and protective tarps.

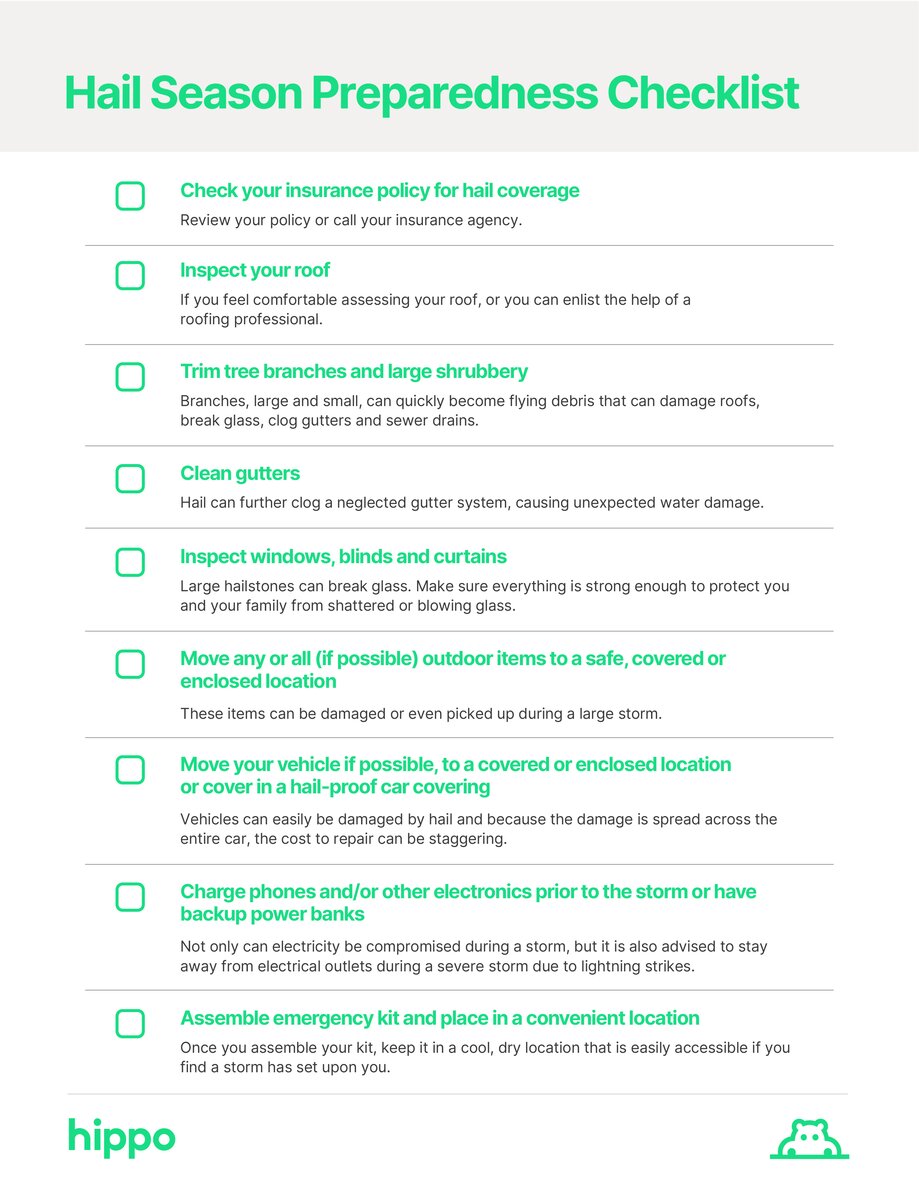

2. Protect the structure of your home

Roof and exterior

Inspect your roof each spring for loose or missing shingles.

Consider impact-resistant roofing materials (Class 4 rated shingles) if you’re re-roofing. These can reduce hail damage and may help lower insurance costs.

Trim overhanging tree branches that could break and fall during storms.

Gutters and downspouts

Clean gutters regularly to ensure proper drainage. Clogged gutters can contribute to water damage after hail and heavy rain.

3. Secure your vehicles

Park vehicles in a garage or covered area whenever possible before a hailstorm.

If covered parking isn’t available, temporary hail covers or heavy blankets can help reduce damage.

4. Secure outdoor items

Hailstorms often come with strong winds. Bring inside or secure:

- Patio furniture

- Lawn ornaments

- Barbecue grills

- Potted plants

- Trampolines

These items can be damaged or become dangerous projectiles during severe weather.

5. Protect windows and doors

To reduce the risk of broken glass and interior damage, consider:

- Storm shutters

- Impact-resistant window film

- Secure window screens or protective barriers

6. Review your insurance coverage

Before hail season begins:

- Review your homeowners insurance policy to confirm hail coverage and understand your deductible. Most standard policies cover hail damage, but coverage details vary by state and policy.

- Consider enhanced coverage options if you live in a high-risk hail area.

- Keep your insurance contact information easily accessible so you can report a claim quickly, if needed.

7. After a hailstorm: Inspect and document damage

Once the storm has passed and it’s safe to go outside:

- Inspect your roof, siding, windows, gutters, skylights, and outdoor structures for dents, cracks, or missing materials.

- Take clear photos and videos of any visible damage.

- Save receipts for emergency repairs or temporary fixes, as these may be required during the claims process.

Prompt documentation can help speed up claim resolution and support a fair assessment of damage.

8. Practice your emergency plan

Make sure everyone in your household knows:

- Where to take shelter during severe weather

- How to access and use your emergency kit

- How to safely shut off utilities, if needed

While hailstorms are unpredictable, preparing ahead of time can help reduce risk and protect your home. Regular maintenance, proactive upgrades, and a clear understanding of your insurance coverage all work together to help you weather hail season with confidence.

Hippo connects homeowners to tailored insurance services, helping ensure your home is kept safe from the unexpected.

This article is for informational purposes only and was compiled from sources not affiliated with Hippo. While we believe this information to be reliable, we do not guarantee its accuracy or completeness. For any insurance-related decision, please consult your licensed insurance producer.